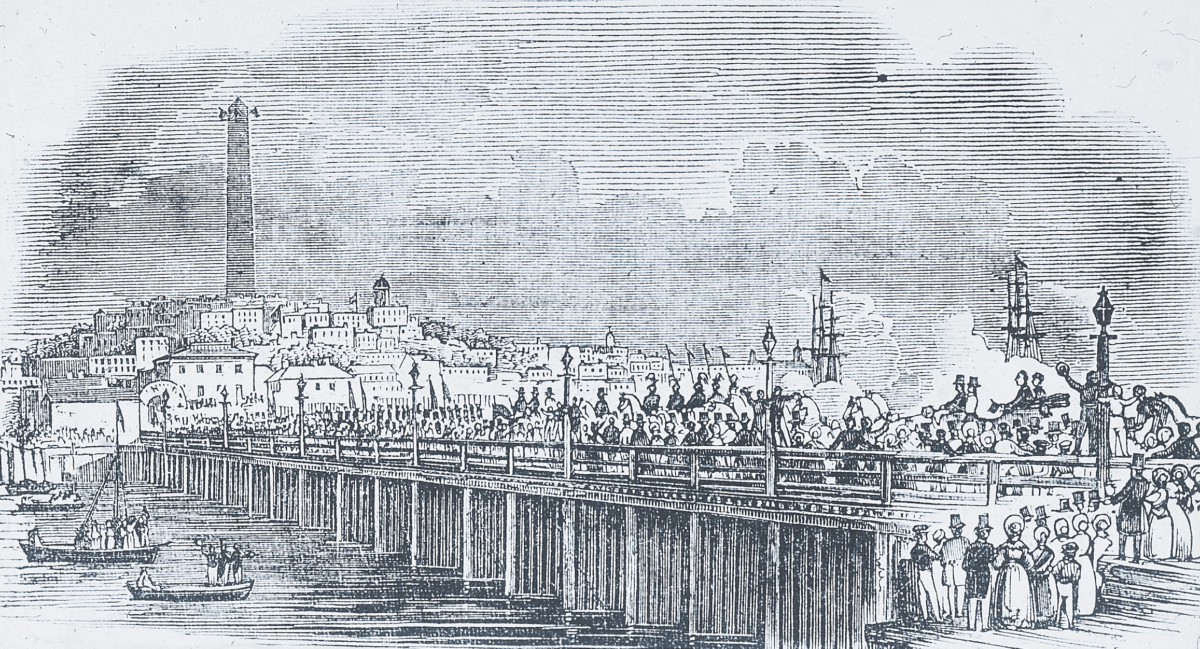

In February 1837, the U.S. Supreme Court, voting 5-2, rejected a claim by owners of a toll bridge in Boston that the Massachusetts legislature had acted unconstitutionally in authorizing construction of a second, competing bridge. The ruling meant little to Bostonians. The second span, the Warren Bridge, connecting their city with the Charlestown neighborhood, then a separate village just across the Charles River, had long been completed. Warren Bridge tolls had so quickly paid off the initial investors that crossings had become free. But the high court’s ruling profoundly affected commercial life in the United States, marking a turning point in the way that government controlled business, encouraged investment in new technology, and, more basically, defined its own legitimate purposes.

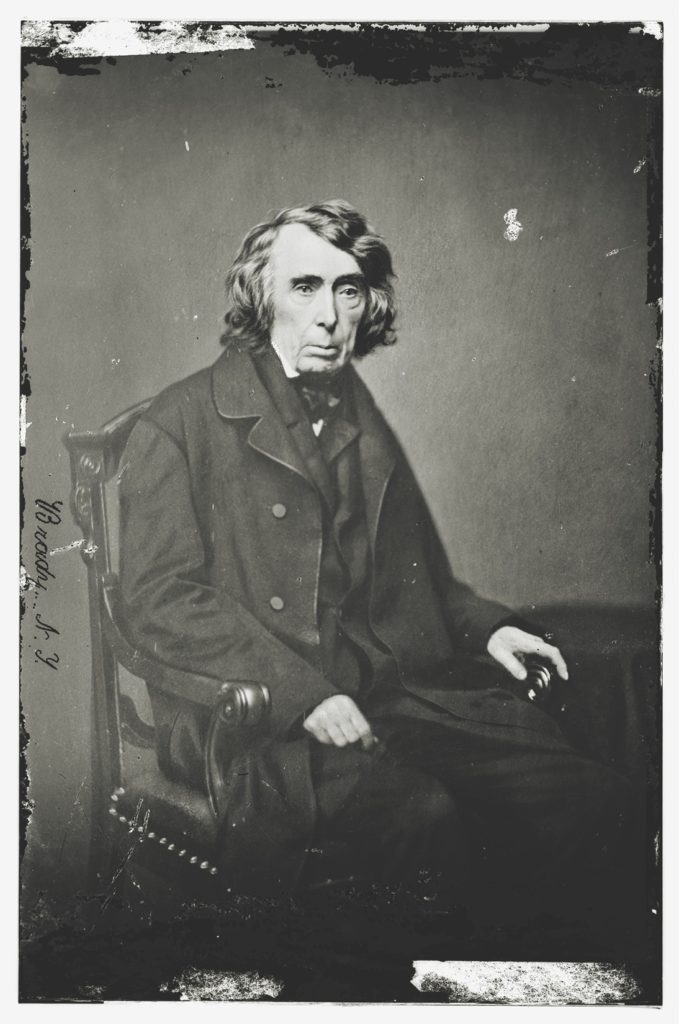

The decision, handed down just 18 days before President Andrew Jackson’s second term ended, was the ultimate victory of Jackson’s populist approach over the more conservative view of government fostered by the Founding Fathers, who tended to defer to the sanctity of business contracts. Rather than adhere to legal technicalities, Chief Justice Roger Taney wrote in Charles River Bridge, government had as its core purpose the enactment of policies benefiting the entire populace.

Charlestown had been settled by some 100 Puritans in 1639, a year before Boston was founded. The settlements obviously needed to trade with one another, and in 1650 the colonial Massachusetts government awarded Harvard College—in need of a reliable funding source—the right to operate a ferry service between the communities. During the ensuing 100-plus years, rising traffic in goods and passengers made clear a ferry was not the most efficient way across the Charles. From the state John Hancock and 83 other investors obtained a charter to build a bridge and, for 40 years, to charge tolls for using it. The 1,500-foot Charles River Bridge opened in 1786, putting Harvard’s ferry service out of business. In compensation, the bridge owners agreed to pay the school £200 a year for 70 years.

The Charles River Bridge was a great success, quickly repaying and rewarding investors, who continued to levy tolls that residents on either bank castigated ever more vigorously as unconscionably high. State politicians were responsive, and in 1828 chartered another company to build and operate a second bridge between Boston and Charlestown. The Warren Bridge was to begin only 300 feet upstream from the Charlestown end of the existing bridge and end 800 feet from its Boston terminus. The charter called for the new bridge to end all toll collecting once investors had recouped and earned a fair profit.

Charles River Bridge investors cried foul. They asked the courts to enjoin the competing project, insisting that their charter conferred an implicit monopoly and that the permit issued Isaac Warren and partners violated the “contracts clause” of the U.S. Constitution. That provision, in Section 10 of Article One, says no state may pass any law “impairing the obligation of contracts.” The early 19th-century court under Chief Justice John Marshall put great importance on that provision and gave it an expansive reach.

The contracts clause had been central to the very first case in which the Justices voided a state law as unconstitutional. In 1795, Georgia sold a parcel now comprising the states of Alabama and Mississippi to four development companies for $500,000. It came to light that many legislators who voted for the sale had side deals to share in profits the speculators stood to reap reselling the land. Voters quickly threw out those lawmakers, and within the year a new legislature revoked the sale. By then innocent buyers had bought many plots. Those buyers challenged the revocation statute in court and won. The underlying corruption “must deeply be deplored,” Marshall wrote in the 5-1 decision, but the original sale constituted a contract, and that was sacrosanct. No later state legislation could nullify it.

The Justices reiterated in subsequent cases that a contract could not be broken. The famous Dartmouth College case went even further: a state could not even amend a contract. Dartmouth had originated under a royal charter that after independence became an agreement with the state of New Hampshire. The legislature in 1816 passed measures making the college a university and enlarging its board. Marshall, in the opinion negating those changes, admitted that when writing the contracts clause the framers had not had such situations in mind but he nonetheless held that the changes impaired a contract, rendering them invalid.

All this suggested that when in March 1831 five days of oral arguments in the case began before the Supreme Court, the owners of the Charles River Bridge stood a good chance of succeeding on their claim that a competing bridge violated their contract, and so was unconstitutional. Except some Justices were not sure and others were off riding circuit, leaving no majority to decide the case. The matter moldered until it was reargued—this time over six days—in 1837. By then the issue of whether to build the Warren Bridge was moot, but the older span’s owners still were hoping to receive damages for the loss of their monopoly.

But Marshall and an ally of his had died; another Justice in his camp had resigned.Jackson appointed all three successors, meaning that of the seven-member court five were his choices. Over dissent by the two senior Justices, the Jackson five found the charter for the Warren Bridge valid. As this quintet interpreted the rights assigned the Charles River Bridge investors, there was no promise of a monopoly on spans over the Charles connecting the towns. But Taney’s opinion went much further. “While the rights of private property are sacredly guarded, we must not forget that the community also have rights,” he wrote, “and that the happiness and wellbeing of every citizen depends on their faithful preservation.”

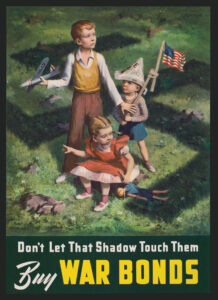

“Taney’s law was flexible, pragmatic, and instrumental,” historian Kent Newmyer of the University of Connecticut wrote, “simultaneously accommodating the dynamic capital and state-based legislative democracy ushered in by the Jacksonians.” That view of government and its power to align business oversight to suit changing conditions bespoke a deep awareness of technology’s march and fear that hewing to government promises of yesteryear would let established businesses stymie new developments. The first American railroad—the Baltimore & Ohio—had been chartered just 10 years earlier; the Ohio & Erie Canal went in just four years before. Taney warned that a decision empowering the Charles River Bridge owners to foreclose competition would give holders of turnpike charters standing to attack rivals. In this scenario, “the millions of property which have been invested in railroads and canals … will be put in jeopardy,” Taney wrote. “We shall be thrown back to the improvements of the last century.”

The contracts clause—enshrining past promises—was no longer to be central to resolving economic disputes. “The clear message from the Charles River Bridge case was that the Supreme Court supported business competition as essential for economic development,” Ohio State University historian Deborah A. Ballam wrote.