In September 1723, in the port of Boston, a very young man—still shy of his 18th birthday—looks for a ship. He finds a captain ready to set sail, and through a friend tells an old, familiar story: He has “got a naughty girl with child.” Would the captain carry him? He would.

The story is a lie.

There is no girl—at least, not this time. Rather, Ben Franklin simply hates working in his brother’s printing shop. He gambles that the captain is more likely to sympathize with a rake than a runaway apprentice. Safely on board, Franklin finds his way to Philadelphia, the city he will call home for much of the next seven decades.

On first landing, he explores, walking up Market Street and then, turn by turn, taking the measure of his new city: “I saw most of the houses on Walnut street…with bills on the doors to be let,” he would later write, “and many likewise in Chestnut and other streets; which made me think then that the Inhabitants of the City were one after another deserting it.”

Franklin is witness to a crisis. Philadelphia is out of cash.

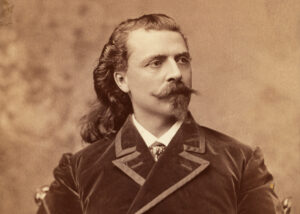

Benjamin Franklin is remembered as the greatest scientist among the Founding Fathers. But he was also the colonies’ most original financial thinker. His breakthrough insight: Money is not a thing; it is an idea. As he worked through the implications of that thought, he arrived at a distinctively American concept of money that turned on the use of paper, rather than gold and silver coins, to settle all debts, public and private.

Coins, of course, had been the only “real” money for centuries. In the colonies, gold and silver coins minted in Britain formed the only legal tender. They were used to pay taxes, settle obligations and buy and sell daily goods. That meant, though, that the economies of the colonies were always vulnerable: A shortage of coins could choke business. Throughout the colonial period, Pennsylvania and most of the other British North American territories were chronically short of hard cash.

The British did it on purpose, using currency restrictions and trade laws to control and extract wealth from the empire. After the short-lived Massachusetts Mint was shut down by order of the crown in 1682, there was no North American source of money, despite colony after colony begging for the right to turn copper, silver and other metals into local coinages. Every legal coin came from the Royal Mint, in the Tower of London. The only other source of hard currency came from trade that brought in foreign coins, such as the fabled “pieces of eight” that were valued by how much silver or gold they contained.

Trade and industry in the New World were strictly regulated—a series of laws originating in 1651 ensured that the colonies could not trade independently with nations other than Britain, and that colonial industries would not threaten similar enterprises in the home country—measures that hit New York, New England and Pennsylvania the hardest. Although colonists did their best to smuggle on heroic scales, the net result was a balance of trade imbalance, hugely to the benefit of Britain. In the 20 years ending in 1717, home country exports to the northern American colonies were almost double imports—£2,710,000 to £972,000. And over time it got worse: In 1759 the New England colonies shipped £38,000 worth of goods to English ports, but spent £600,000 on imports from Britain. Covering the difference between those two numbers required hard cash, so much of the ready money in the colonies was sucked back across the Atlantic.

Arriving in Philadelphia at age 17, Franklin would take some time to work all of this out. Eventually, though, he realized that if there wasn’t enough metal coinage around, it could be replaced with a promise.

Massachusetts was the first colony to experiment with paper money, issuing notes in 1690 to pay the cost of a military expedition against French-held land in Canada. After that successful experiment, several New England colonies and others released more paper money over the next several years, increasingly aimed at a shortage of coins. But some colonial paper began to depreciate—losing value against silver or gold—when governments printed larger and larger quantities.

That weakness scared the cautious Pennsylvania administration away from the idea, until finally the crisis of 1723 grew so acute that the legislature decided to print £15,000 of paper notes. To make sure it wouldn’t depreciate, each note was backed by land and houses. In effect, people who received the notes took out a loan, or mortgage, against their property.

The infusion of paper money worked, and the slump waned. But the underlying causes remained: still not enough coinage from Britain combined with a trade deficit. The 1723 issue was designed to be temporary—the government retired notes as they received them as taxes or in repayment of the loans against which they had been issued. That meant ready cash ran short again as early as 1728. As the Pennsylvania Gazette reported: “Trade has been long in deep Consumption, her Nerves relax’d, her Spirits languid…[so] that she now lies bleeding in very deplorable condition.”

The response seemed obvious: Paper money had worked once, so why not try again? Yet many of Philadelphia’s wealthy and well-connected men organized to block the proposal in the Pennsylvania legislature. Based on the experience of other colonies with depreciation, of paper money losing its value, they asserted there was only one truly secure form money could take: silver and gold coin. It was a grand claim, a defense of principle—and it had all the weight of tradition. But was it true?

Benjamin Franklin, just 23 years old, said no.

On April 3, 1729, Franklin published a pamphlet with the falsely humble title A Modest Enquiry into the Nature and Necessity of a Paper Currency. It may be the least known of the great founding documents of the American experiment, but in it, he eviscerated his wealthy opponents. They had no real principle at stake, he wrote. Rather, they were greedy, relentlessly pursuing their own self-interest. The rich love currency crises because a lack of coins in circulation allows those who hold gold or silver to “practise Lending Money on Security for exorbitant Interest.” And, when times are tough, the wealthy can scoop up property at fire-sale prices. Without the trade that a robust money supply evokes, “the Common People in general will be impoverished, and consequently obliged to sell More Land for less Money than they will do at present.” Worse, Franklin predicted, when the land grab ends, those same purchasers will support expansion of the money supply, boosting the value of their new property.

Franklin argued that a well-run paper currency would ultimately benefit everyone: An adequate money supply lowers interest rates, encourages trade, creates more demand and raises the value of the colony’s products. He insisted that “labouring and Handicrafts Men (which are the chief Strength and Support of a People)” would move to Pennsylvania and those who were present would stay. Otherwise, skilled workers would seek “entertainment and Employment in other Places, where they can be better paid.”

Franklin simply made a pragmatic case: Paper money would solve the particular problem at hand. But what came next was his great revelation. How could paper currency ever be “real” money? Franklin’s answer was to recognize that money itself was simply a medium of exchange, a measure of value rather than its storehouse. Money allows the three pennies worth of bread Franklin bought on his first day in Philadelphia to become three pennies worth of laundering the baker needed done. The three coins Franklin handed to the baker served as a way of measuring how much the bread or the laundry was worth to each buyer and seller. Franklin argued that what was actually being exchanged was the work involved in making bread or washing clothes. That, and not the melted-down price to be had for the metal within the coins, gave the term “three pence” its true measure. Franklin concluded that money in circulation derived its value from the sum of all such transactions—all things made and all the services people exchange.

Franklin conceded that paper money could be debased if the issuing authority printed too many notes. The remedy for that was already at hand. Pennsylvania had backed its 1723 issue with land: To get your hands on a sheaf of bills, you had to borrow against the value of your property. That meant, Franklin wrote, that paper money could be imagined as “coined land,” and it also provided a protection against any drastic change in the value of such a currency. Should too many notes circulate and lose exchange value against silver or gold, landowners would snap them up to retire their mortgages; if too few, then more people would mortgage their land to acquire notes. This is a strikingly modern understanding. Over the next 50 years, Franklin revisited his defense of paper money, but his core idea did not change: It was a crucial obligation of a government to ensure that its citizens had an adequate supply of money. Once thus properly supplied, the freely undertaken choices those citizens made would secure its value.

At the point of the crisis in 1729, Franklin’s argument overwhelmed the opposition. In May that year Pennsylvania’s legislature authorized the issue of £30,000 in paper notes. The colony soon grew richer, and so did Franklin. He was, after all, a printer, recognized as one of the best in Philadelphia. He received his first contract to print Pennsylvania notes in 1731. It was, he wrote, “a very profitable job, and a great help to me.” Giving credit where it was due, he noted that his success was “gained by being able to write.”

Before long, Franklin became a prosperous man as the go-to printer for currency in the mid-Atlantic colonies. By 1764 he had printed 14 issues of Pennsylvania money. He also printed Delaware and New Jersey currency, running off about 2.5 million notes in all. And as he developed his technique, he came up with a new solution to the problem facing all paper currency: how to prevent one printer from copying what another has done.

Early on, Franklin tried to deter counterfeiting with tricks. He used multiple fonts for the type on each note, added complex engraving and decoration, and even laid traps like varying the spelling of “Pennsylvania” on different denominations. But these were simply well-executed versions of familiar deterrents. What came next was wholly his, an innovation that at least conceptually is incorporated in every note in circulation today.

The idea came to him as he looked at the work of a friend, botanist and artist Jacob Breitnall. In the early 1730s, Breitnall made a series of exquisitely detailed images of leaves, using an old printmaker’s technique of rolling ink onto a leaf, then pressing that inked surface onto a sheet of paper. The images were fragile one-offs. But what Franklin noticed was that no two leaves, even from the same tree, are absolutely identical—the pattern of veins differs from leaf to leaf. That meant that if he could figure out how to transfer Breitnall’s delicate work onto metal plates, each of his bills would have a unique signature, an image from nature that could not (at least without heroic effort and skill) be precisely reproduced.

It was a clever idea, but it took Franklin several years to figure out how to get Breitnall’s delicate prints onto a printing press. Others had experimented with the idea of making plaster casts of similarly detailed forms. But to produce a plate suitable for printing required transferring that plaster “negative” to a metal “positive.” Such casts shatter when filled with molten metal. Exactly how Franklin worked around this obstacle remains unknown. The best guess is that he adulterated his plaster recipe with a fireproof material like asbestos.

By 1736 Franklin published his first nature print—of a rattlesnake leaf—in Poor Richard’s Almanac. Soon after, leaf prints appeared on the backs of a 1737 series of notes produced for New Jersey. As each design circulated in quantity, that mass of legitimate notes served as the reference against which to check any dodgy bills someone might try to pass.

It worked. The four colonies that displayed nature prints on their paper currency suffered much less counterfeiting than those that used simpler designs. The ultimate accolade came in 1775 when the Continental Congress authorized the creation of a national currency. Before new images could be made, the first Continental dollars used recycled images from Franklin’s work of decades before.

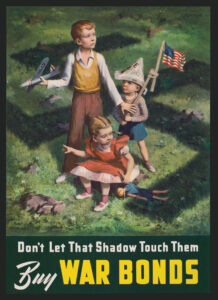

However, the Continental dollar soon earned a terrible reputation. As early as 1778, Continentals traded at one-fifth face value, and by 1781 they were worthless. The primary cause was that Congress printed too many notes—about $200 million, much more than the credit of the new government could support. Franklin later claimed that he had warned of this, writing Josiah Quincy, “It is some Consolation to me that I wash’d my Hands of that Evil by predicting it in Congress.”

But the Continental notes had help on the way down. In January 1776, in the first use of counterfeiting as a weapon of war, the British set up a printing press aboard the Royal Navy’s HMS Phoenix, anchored in New York Harbor. More presses on both sides of the Atlantic flooded the markets. The British got enough good fakes into circulation to force the destruction and reissue of about $40 million of new currency.

Even in the face of such attacks, though, the Continental dollar survived just long enough to do its job. Congress had issued the notes to pay for the costs of a war it lacked other resources to support. Those who accepted paper money received, at war’s end, one penny on every dollar they still held—the other 99 cents, in essence, was donated to pay the cost of fighting the American Revolution. Franklin, for all his private grumbling to correspondents like Quincy, accepted this as a necessary evil. He wrote in 1779, “This currency, as we manage it, is a wonderful Machine. It performs its Office when we issue it; it pays and clothes Troops, and provides Victuals and Ammunition; and when we are obliged to issue a Quantity excessive, it pays itself off by Depreciation.”

One should think of this loss of value, Franklin wrote, as a tax—“the most equal of all Taxes, since it depreciated in the Hands of the Holders of Money, and thereby tax’d them in proportion to the Sums they held and the time they held it which generally is in proportion to Men’s Wealth.” Note what Franklin said: He favored a progressive tax to pay for the creation of the United States. The rich should pay the most, for they were best able to afford it, and (though he did not say so explicitly) they had the most to gain from independence.

After the war Franklin remained a paper money proponent. He had long since left the work of printing to others, but he did not abandon his quest for a counterfeit-proof bill. In 1789 his grandson, Benjamin Franklin Bache, won a commission to produce notes for the Bank of North America. He printed some of them on special marbled paper his grandfather provided. The paper was elegant—but that wasn’t the point. Marbling was a specialized skill, and the use of such elaborate (and expensive) print stock added another hurdle for a counterfeiter to leap.

Franklin died the next year. Some of his innovations, like nature printing, died with him. But his recognition that money is simply a medium of exchange, a tool and not of independent value, is so deeply rooted now that it takes enormous imagination to remember how radical it was in his day.

His practical wisdom holds, too. Microfibers, colored threads, fluorescing inks and the rest, the arsenal of modern anti-counterfeiting tricks currently used by the U.S. government, can be traced to that Philadelphia master printer, whose pictures of leaves helped launch a paper money society.

Thomas Levenson is director of the graduate program in science writing at the Massachusetts Institute of Technology. He has written for the Atlantic Monthly and Discover magazines. His latest book is Newton and the Counterfeiters.

Originally published in the October 2010 issue of American History. To subscribe, click here.