Cold weather still gripped most of the country on Sunday, March 12, 1933, as President Franklin Delano Roosevelt prepared to speak to the American people from the White House. The radio networks of the National Broadcasting Company and Columbia Broadcasting System had agreed to suspend regular programming at 10 p.m. Eastern time, and millions of Americans huddled around their radios in kitchens, parlors and living rooms. Forced by hard times to skimp on home heating fuel, they bundled in blankets and overcoats on this late winter night waiting, with everyone else, to hear the president.

Moments before air time, the reading copy of Roosevelt’s prepared remarks—triple-spaced and typed by assistant Grace Tully with a special blue ribbon—disappeared. Staff members flew about trying to find it, but Roosevelt calmly retrieved one of the smudged, single-spaced mimeographed copies that had been prepared for the press, and read from that.

“I want to talk for a few minutes with the people of the United States about banking,” he began. Listeners recognized the voice, but it sounded different tonight. Roosevelt’s tenor typically rose when he projected to large crowds; now it retained its conversational tone. He spoke quietly, even soothingly, like a favorite uncle telling a bedtime story. There was no levity in his words or his inflection, but neither was there obvious gravity. A traveler from a distant country, unfamiliar with the crisis facing America, would never have guessed how much hung on Roosevelt’s every word as he delivered his first fireside chat to the nation just eight days after his inauguration.

Echoes of the crisis Roosevelt inherited when he took office 75 years ago can be heard today in news reports of home foreclosures and tottering financial institutions. But what resonates more deeply across the decades is an abiding faith in the long-term resilience of the American economy—a faith that Roosevelt helped foster during a brief radio address delivered amid a run on banks that raised troubling questions about credit, the value of the dollar and the future of capitalism. The story of how Roosevelt stopped a nationwide panic and restored Americans’ confidence in the banking system is a case study in presidential theatrics and the remarkable power of moral suasion when exercised by a visionary leader.

Presidents had been speaking to the American people since the birth of the republic. The inaugural addresses of every president from George Washington to Warren Harding had been pitched at the entire nation, although they were heard only by those in attendance at the inaugural ceremonies. Presidents’ annual messages to Congress functioned similarly: delivered to a discrete audience but intended for Americans at large. Yet during the century between Thomas Jefferson and William Howard Taft, the annual messages had been delivered to the Senate and House in writing and were read to the legislators by clerks. Woodrow Wilson revived the practice of delivering the annual message orally, but even then the American people had to wait to read the speech in their local papers. The president’s words were history before they reached their ultimate audience.

The rise of radio created new possibilities for connecting with the people. Calvin Coolidge gave his inaugural address on the radio to a patchwork of stations connected by telephone lines. Yet Coolidge was dubbed Silent Cal for a reason, and neither he nor his successor, Herbert Hoover, seriously explored radio’s technological potential.

Nor did they explore radio’s psychological potential. Radio continued a shift in the political center of gravity in Washington that had been underway for decades. During the 18th and 19th centuries, the great communicators in American politics had been members of Congress. Listeners swooned at the soaring phrases of Henry Clay, Daniel Webster and John Calhoun, not at the pedestrian utterances of Martin Van Buren, Millard Fillmore and Ulysses Grant. Abraham Lincoln’s rare gems—his Gettysburg address, his second inaugural—were the exceptions that proved the rule of executive forgettability in American public speaking.

Things changed under Theodore Roosevelt. The master of the “bully pulpit” understood the moral and emotional power of the presidency, and his speeches sounded like sermons as he lashed the “criminal rich” and “malefactors of great wealth” for conspiring against the public. Wilson sermonized, too, although mostly about foreign affairs. Wilson summoned Americans to war in 1917 in order to make the world “safe for democracy,” and he offered his Fourteen Points as a guide to a better future for humanity.

Franklin Roosevelt studied his predecessors closely. During visits to the White House during the presidency of Theodore Roosevelt, his fifth cousin and his uncle by marriage, Franklin mentally tried the residence on for size. FDR patterned his political career on TR’s, starting with a stint in the New York legislature, followed by service with the Navy Department and then the governorship of New York. The navy posting afforded Roosevelt a good opportunity to observe the inner workings of the Wilson administration. For 7 1/2 years, as assistant navy secretary, he noted Wilson’s successes and failures, and he paid particular attention as Wilson toured the country to enlist popular support for the Treaty of Versailles and the League of Nations. Everywhere Wilson went, he stirred audiences with his vision of American leadership in the world. He might well have forced a skeptical Senate to accept the treaty and the League, but a stroke felled him and his magnificent voice went silent.

Roosevelt was still reflecting on Wilson and the power of presidential words when his own turn came. Not since Lincoln had a president assumed office under such disheartening circumstances. The stock market crash of 1929 had presaged the implosion of the American economy. Industrial production had fallen by half; industrial construction by nine-tenths. The steel industry, long a mainstay of America’s might, was staggering along at barely 10 percent of capacity. Unemployment topped 12 million, and even this figure understated the problem, for it ignored those too discouraged to continue seeking work. Commodity prices had collapsed, forcing farmers to struggle ever harder to make ends meet, until the prices fell so far that the farmers couldn’t afford to harvest their wheat and corn, and let it rot in the fields.

Hundreds of thousands of families lost their homes; as many as 2 million men, women and children wandered the highways of America seeking shelter. Homeless communities, called Hoovervilles in derision of the Republican president, sprang up in cities all across the country. The shantytowns at first hid under bridges and in gulches but eventually spilled into plain sight. Manhattan’s homeless claimed the shore of the Hudson River from 72nd Street to 110th.

Hunger stalked the land, visibly afflicting the crowded shanty towns, invisibly sapping the strength of sufferers on isolated farms and in end-of-the-road hamlets. Some of the starving were reduced to an animal existence; they fought over scraps behind restaurants and in garbage dumps. “We have been eating wild greens,” an out-of-work Kentucky coal miner reported unemotionally. “Such weeds as cows eat.”

“You could smell the depression in the air,” one survivor remembered, before switching metaphors: “It was like a raw wind; the very houses we lived in seemed to be shrinking, hopeless of real comfort.” A journalist in Washington remarked at the time: “I come home from the hill every night filled with gloom. I see on the streets filthy, ragged, desperate-looking men, such as I have never seen before.”

In the month before Roosevelt’s inauguration on March 4, 1933, the crisis centered on the nation’s financial sector. The stock market crash had punished many banks, as borrowers defaulted on loans they had used to underwrite speculation, and as speculating banks suffered from their own bad investments. Weak banks dragged stronger ones down when panicked depositors demanded their money, which the banks, having loaned it out, couldn’t deliver. Five thousand banks had folded by the time Roosevelt took office, and perhaps 10 million Americans had lost their savings.

In several states the entire banking industry ground to a halt as governors suspended bank operations. The governor of Louisiana locked the bank doors in his state in early February; the governors of Michigan, Maryland, Indiana, Arkansas and Ohio did likewise during the next two weeks. Roosevelt reached Washington 48 hours ahead of his inauguration and took the presidential suite at the Mayflower Hotel; the walls there were festooned with slips of paper detailing the unfolding debacle: “Boise, Idaho: Acting Governor Hill today declared a fifteen-day bank holiday….Salem, Oregon: Governor Meier declared a three-day bank holiday….Carson City, Nevada: A four-day legal holiday….Austin, Texas….Salt Lake City, Utah….Phoenix, Arizona….”

The dollar losses were staggering. The Federal Reserve reported an outflow of more than $700 million in seven days ahead of the inauguration as surviving banks scrambled frantically to meet their depositors’ demands. The bleeding escalated to $500 million in the final two days before the inauguration.

Gold grew more precious than ever and scarcer. An all-time record of $116 million of gold was withdrawn from the Fed banks in a single day, as foreign account holders lost faith in the dollar and insisted on the yellow metal. Domestic holders of dollars began to get nervous. They fingered their Federal Reserve notes and wondered whether and how the government would honor the promise engraved on each: “Redeemable In Gold On Demand At The United States Treasury, Or In Gold Or Lawful Money At Any Federal Reserve Bank.”

Roosevelt presented a curious mix of reassurance and challenge to the nation in his inaugural address. “The only thing we have to fear is fear itself,” he said. Yet he proceeded to catalog some dauntingly real reasons for fear. “The means of exchange are frozen….The withered leaves of industrial enterprise lie on every side….Farmers find no markets for their produce….The savings of many years in thousands of families are gone.” Roosevelt likened the nation’s dire economic predicament to a war and promised bold action. Americans must operate in unison, he said, “as a trained and loyal army.”

Roosevelt then promptly moved to stanch the hemorrhage of gold from the banks by doing what the governors had done but on a broader scale. Inauguration Day was Saturday; on Sunday all the banks were closed. At 1 o’clock on Monday morning, March 6, he issued a decree declaring a national bank holiday. During the suspension, all normal banking operations would be barred. No bank was allowed to “pay out, export, earmark, or permit the withdrawal or transfer in any manner or by any device whatsoever, of any gold or silver coin or bullion or currency.”

The move took the country’s breath away. Without consulting Congress or, apparently, the Constitution, the president had declared economic martial law. Deposits were frozen; customers of the country’s 18,000 banks were prevented from even trying to get their money out. The embargo on gold effectively took the United States off the gold standard, at least for the duration of the bank holiday.

Roosevelt cited an obscure law most people thought had lapsed—the 1917 Trading With the Enemy Act (which gave the president the wartime power to prohibit hoarding gold)—as justification for his diktat. Opinions differed sharply on whether the law was still in force, let alone whether it supported a peacetime stroke of the magnitude Roosevelt had just delivered.

Yet so desperate was the country for decisive action that almost no one in political or business circles seriously challenged the president. Even the Wall Street Journal approved. “A common adversity has much subdued the recalcitrance of groups bent upon self-interest,” the de facto mouthpiece of the financial sector observed. “All of us the country over are now ready to make sacrifices to a common necessity and to accept realities as we would not have done three months ago.”

The bank holiday bought Roosevelt time but only a little. He immediately set his advisers to writing a remedy to the financial panic. William Woodin, the Treasury secretary, led the effort. “We’re on the bottom now,” Woodin told reporters in a rare break between drafting sessions. This was supposed to be reassuring. “We are not going any lower,” he said.

Woodin and the others—including governors of the Federal Reserve, chairmen of private banks, members of key congressional committees, and academic and professional economists—worked until 2 o’clock each morning at the White House. They went home for a few hours’ sleep before returning for more of the same. The pressure was tremendous. “We’re snowed under, we’re snowed under,” Francis Await, the comptroller of the currency, muttered. But Woodin kept them on track. “Not once did his grey toupee slip askew in the excitement,” a reporter remarked.

Roosevelt wanted to have a bill by Thursday morning, March 9. He had summoned an emergency session of Congress, and he wished to present the lawmakers with a finished product as they gathered that noon. But the myriad intricacies of the money question defied such rapid solution, and when the session convened, the administration’s measure was still at the printer’s shop. Congress went ahead nonetheless and, employing a folded newspaper as a proxy for the actual bill, approved it on the president’s recommendation and that of those lawmakers who had seen a draft of the legislation. The measure stamped retro active approval on the bank closure and the gold embargo, and it authorized the president to reopen the banks when he deemed appropriate and to reorganize the national banking system to protect strong banks from the weak.

Roosevelt signed the bill that Thursday evening and shortly announced a timetable for reopening the banks. The 12 Federal Reserve banks would open on Monday, March 13, along with the other banks in those 12 cities. Banks in most other cities would open on Tuesday. Banks in small towns and villages would open on Wednesday.

There was less to the bank law than met the eye. Roosevelt had needed to stem the panic, and closing the banks did so. The bank law made the process look legal and planned. But the question on which everything hung—the condition of American finance, the direction of the economy, even the fate of America’s distinctive mix of capitalism and democracy—was whether confidence could be restored by the time the banks reopened. If it was restored, the rescue operation would succeed. Prosperity might remain some distance off, but the country could begin moving in that direction.

If confidence was not restored, all the effort would have been wasted. Pessimists noted that democracy was failing in other countries that couldn’t solve their economic problems. Germany had installed Adolf Hitler as chancellor a month before Roosevelt was inaugurated. A week before the American inauguration, Nazi agents burned the Reichstag and blamed the German Communists. Hours before Roosevelt closed the American banks, German elections returned a parliamentary majority for Hitler’s coalition. Hitler demanded, and quickly received, dictatorial powers from the intimidated legislature.

Roosevelt’s foremost objective as he began his first fireside chat on March 12 was to sound a note of calm. Millions had tuned in to his inaugural address, just a week before, but that speech had been delivered to a live audience in Washington, D.C., with the radio listeners merely eavesdropping. Now the radio listeners were the president’s sole audience, aside from the few family members and administration officials sitting with him in the Oval Office, as he offered a matter-of-fact explanation of what had precipitated the banking crisis. “Because of undermined confidence on the part of the public, there was a general rush by a large portion of our population to turn bank deposits into currency or gold—a rush so great that the soundest banks could not get enough currency to meet the demand,” he said. “The reason for this was that on the spur of the moment it was, of course, impossible to sell perfectly sound assets of a bank and convert them into cash except at panic prices far below their real value.”

To remedy the situation, Roosevelt said, he and Congress had taken two important steps. First, he had declared the bank holiday, to give bankers, depositors and everyone else a chance to catch their breath. Second, Congress had approved the bank bill, confirming his authority over the banking system and allowing him to reopen the banks in an orderly fashion.

Roosevelt explained the timetable for the reopenings, and he asked for special patience on the part of depositors. “There is an element in the readjustment of our financial system more important than currency, more important than gold, and that is the confidence of the people,” he said. “Confidence and courage are the essentials of success in carrying out our plan. You people must have faith; you must not be stampeded by rumors or guesses. Let us unite in banishing fear. We have provided the machinery to restore our financial system; it is up to you to support and make it work. It is your problem no less than it is mine. Together we cannot fail.”

Whether it was his tone of voice, his choice of words, the nature of the medium or a sudden desire on the part of Americans to please their new president, Roosevelt’s 15-minute talk evoked a stunningly positive response. Thousands of telegrams poured into the White House overnight. “Created feeling of confidence in me and my family,” one said. Another asserted: “Going direct to the people with the facts has inspired every confidence in the reopening of the banks.” A third called the talk “a masterpiece in the circumstances and worthy of the historical precedent it established.”

Editors and pundits fell over themselves in praise of Roosevelt’s performance. The New York Times sensed a sudden change in the popular mood: “His simple and lucid explanation of the true function of a commercial bank; his account of what had happened, why it had happened, and the steps taken to correct the mischief were admirably fitted to cause the hysteria which had raged for several weeks before the banks were closed to abate if not entirely to subside.”

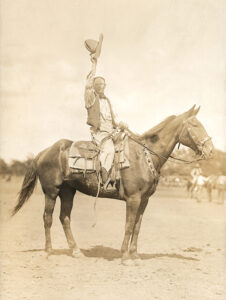

Will Rogers labeled the speech a “home run” and considered it a model of straightforward eloquence. “Some people spend a lifetime juggling with words, with not an idea in a carload,” the popular cowboy humorist observed. “Our President took such a dry subject as banking (and when I say ‘dry’ I mean dry, for if it had been liquid he wouldn’t have had to speak on it at all). Well, he made everybody understand it, even the bankers.” Sen. James Lewis marveled at the powerful emotional impact of the president’s remarks. “I have never seen within my political life such a real transformation in sentiment from discouragement to encouragement, from despair to complete hope and to immediate new trust and new hope,” the Illinois Democrat declared.

Roosevelt was pleased at the praise but cared more for the financial effect of his message. The evidence from this direction was irrefutable. As the banks reopened, the negative currency flows of the previous weeks were reversed: Depositors stopped withdrawing funds and started returning the money they had pulled out. Bank balances began growing again, engendering additional confidence and further deposits. By the time the last banks opened, the crisis had passed.

The expeditious rescue of the banks didn’t end the pressure on the larger economy. The grim statistics on national income, production and employment remained as dismal as ever. Central questions about the value of the dollar, the future of gold, the security of deposits and the structure of the industrial system were still to be answered.

But the emergency of the moment had been surmounted by Roosevelt’s brilliant act of political theater. Raymond Moley, one of Roosevelt’s advisers, later remarked that “capitalism was saved in eight days.” He could have been more specific. The essence of the crisis was distilled into the quarter-hour of Roosevelt’s fireside chat. Had the president failed to win the confidence of America that Sunday evening, the bank runs would have resumed and the downward spiral would have continued. But he didn’t fail, and the banks, and capitalism, were saved.

In the bargain, Roosevelt fashioned a new link between presidents and the American people. The New York Times, in the same editorial in which it lauded the efficacy of Roosevelt’s words, commented on the method of their delivery: “The President’s use of the radio for this purpose is a fresh demonstration of the wonderful power of appeal to the people which science has placed in his hands. When millions of listeners can hear the President speak to them, as it were, directly in their own homes, we get a new meaning for the old phrase about a public man ‘going to the country.’” Roosevelt went to the country without leaving the White House, and American politics would never be the same.

Originally published in the October 2008 issue of American History. To subscribe, click here.