Conservative Senator Nelson Aldrich joined progressive President William H. Taft in supporting a constitutional amendment on federal income taxes because he knew it wouldn’t pass. But Aldrich got it all wrong.

THIS YEAR, to the chagrin of millions of Americans, the federal income tax celebrates its centennial. Yet despite the perennial groans that go up every April 15, the income tax has proven pivotal in defining modern America. Changes ushered in by the passage of the 16th Amendment to the Constitution in 1913 have permanently and profoundly transformed relations between Americans and their government and have redistributed wealth and power among rich and poor, city and countryside, farmer, manufacturer and financier.

Little of this was envisioned by advocates of the federal income tax before World War I, when lower-income Americans—many calling themselves “Progressives”— were simply seeking a little equity in a tax system that clearly favored the wealthy. By today’s standards, the first federal income tax was minuscule.

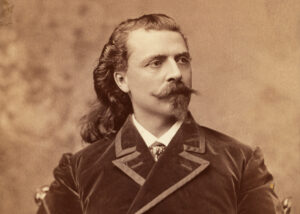

What makes the story of the 16th Amendment’s passage especially intriguing is that some of its leading public proponents—most notably powerful Republican Senator Nelson W. Aldrich of Rhode Island—were actually stalwart opponents of a federal income tax. But when passage of income tax legislation in Congress seemed likely, Aldrich embraced an idea floated by President William Howard Taft: Seek a constitutional amendment allowing federal income taxation. Aldrich and his fellow tax opponents favored the amendment strategy because they calculated that it had virtually no chance of passing.

They miscalculated—on a grand scale. The gambit backfired. What seemed like a shrewd short-term strategy ushered in a tax revolution that is still with us today.

The Old Regime: Taxing Consumption

The Constitution famously invested the federal government with the power to levy taxes, but it is often forgotten that this was an “indirect” power. That is, the central government could tax imports, the sale of goods, and property (such as land), but it could not collect a portion of an individual citizen’s income. This principle guided the nation’s first—and most enduring—tax regime, which stretched from the 1788 ratification of the Constitution to the 1913 passage of the 16th Amendment, with two minor periods of exception.

Tax politics, an American blood sport, has been guided by at least three shrewd tactics. The first we might refer to as the Willie Sutton approach, named for the notorious gangster who, when asked why he robbed banks, allegedly replied, “That’s where the money is.” In similar fashion, legislators are naturally drawn to flush sources of tax revenue. The second dictate—often at odds with the first—is to avoid taxes on political and economic elites. Third, the less obvious the tax, the better. We complain less when licensing fees go up than when our paychecks shrink.

The young, economically undeveloped nation followed these tacit rules by taxing imports and land, which were in superabundance, as well as the sale of tobacco and liquor. The tariff was especially popular because it shielded nascent manufactories from fierce competition from imports. Land sales and imports were so brisk and the size of federal government so small (it mainly comprised salaries for troops fighting Indians) that for much of the 19th century the United States ran budget surpluses—a condition almost inconceivable today.

War runs up massive bills and hurts trade (and therefore tariff revenues), so it is not surprising that Alexander James Dallas, Treasury secretary during the War of 1812, proposed a national income tax. The attempt failed—this was a nation fresh from the anti-taxation American Revolution, after all—although Dallas managed to avert fiscal disaster through other means.

The Civil War Experiment

The Civil War chalked up huge federal expenditures and inspired many new tax proposals (along with the usual wartime finance strategy of printing money, which, in effect, levies a tax on all citizens by devaluing currency). The new tax measures enacted by Northern congressmen mainly raised or introduced new tariffs and excise (sales) taxes. The problem—political for the lawmakers, economic for most taxpayers—was that both tariffs and excise taxes were essentially consumption taxes and therefore very regressive: Everyone paid the same percentage of tax, so day laborers took a proportionately larger hit than their bosses.

Fearing political backlash from skyrocketing consumption taxes, some politicians—especially Republicans, who were widely seen as beneficiaries of regressive taxation because most of the wealthy held that party affiliation—proposed an emergency (that is, wartime) property tax. But the idea was opposed in the West, where wealth lay disproportionately in land. Farmers, merchants and landowners there complained that capitalists in the East, who held most of their wealth in non-land assets, would escape paying their fair share. Justin S. Morrill, then a Republican congressman from Vermont, had a different idea. Taking a cue from the British Empire, which had recently enacted an income tax to help fund its Crimean War adventures, Morrill proposed a simple 3 percent tax on annual incomes over $800. To defend its constitutionality, the proposal’s supporters argued it was not a direct tax because it didn’t tax property values.

The bill passed (as the Revenue Act of 1862), and with it came the nation’s first Bureau of Internal Revenue. The experiment produced several results. For one thing, income tax revenues were more generous than expected, especially after Congress in the first year raised the rate on incomes over $10,000 to 5 percent, and two years later raised all the rates (to 5 percent for incomes in the $600 to $5,000 range; 7.5 percent on $5,000 to $10,000 income earners; and 10 percent above that). At those rates, the tax was reaching down from top earners into the upper middle class, or roughly the top 10 percent of households. By the end of the war, the new income tax had generated some $61 million, or about a fifth of all federal tax revenues.

A winner for government coffers, the new tax was a political debacle. Lawmakers, led by Republicans, began to unwind it, first by lowering rates and expanding exemptions in 1867 (but cautiously extending the tax in 1870 out of a fear of looming deficits), then by letting it expire in 1872. The great Civil War experiment in federal income taxation was understood as just that—a temporary war expedient that served its purpose until the status quo returned. After 1872, the Treasury again relied on high tariffs, taxes on certain luxury goods, and alcohol and tobacco “sin” taxes. And in the Gilded Age, there was plenty of sin of that sort to pay the bills. From the 1870s to 1913, alcohol and tobacco would generate between one-half and one-third of the nation’s federal taxes, in some years more than the tariff.

Industrialization, Progressivism and Tax Justice

The old regime of regressive, consumption-based taxation could not hold. At the turn of the century, the United States was changing, broadly and deeply, from a fragmented, rural, agricultural nation to an interconnected, urban, industrial one. A new tax regime was needed for the new order. But change was halting.

As the burgeoning economy was plagued with periodic economic and financial crises—in 1873, 1893 and 1907— some legislators again looked to new income taxes to help balance the federal books. Between 1873 and 1879 alone, congressmen from the Upper Midwest and the Southeast introduced 14 national income tax bills. None passed, thanks in large part to staunch resistance from the Northeast, whose wealthiest citizens were well aware that during the Civil War experiment, a mere three states—New York, Massachusetts and Pennsylvania— generated 60 percent of the nation’s federal tax revenues.

It was precisely this growing disparity between haves and havenots (oil magnate John D. Rockefeller by this time was worth $1 billion—in 1890s dollars—about 2 percent of GDP) that was inspiring farmers, laborers and small businessmen to call for a more progressive tax system. Their clarion call was “ability to pay,” and they agitated for the redistribution of some wealth from affluent individuals and corporations toward lower-income earners. Progressive taxation became a key issue for the anti-establishment Populist Party, which ran James B. Weaver for president of the United States in 1892, but also gained widespread support among Democrats. When another severe depression struck in 1893 and Democrats took control of both houses of Congress, the stage was set for major tax reform.

Catering to Democratic wishes, the Wilson-Gorman Act of 1894 lowered tariffs while seeking to make up the lost revenue with a relatively mild national tax of 2 percent on incomes above $4,000. Like all U.S. tax legislation, it was a compromise measure, thanks in this case to robust resistance not only from Republicans in Congress but also from many Democrats in the Northeast.

Wilson-Gorman survived less than a year, struck down by the U.S. Supreme Court in Pollock v. Farmers’ Loan and Trust Co., a 5-4 decision. The court ruled the 1894 law unconstitutional because its taxation of interest, dividends and rents was not apportioned according to state populations. Democrats were incensed, and in 1896 theirs became the first major political party in U.S. history to support a federal income tax. That year their candidate, Williams Jennings Bryan, lost his bid for the White House to the Eastern establishment’s Republican candidate, William McKinley. When the U.S. entered the Spanish-American War in 1898, pro-tax Democrats sensed a new opportunity for income tax war finance, and railed against Pollock as “a legal anomaly” while fearing that the Supreme Court would strike down any new tax legislation. Congress paid for the war by doubling sin taxes, among other non-tax measures.

Progressivism burst into full bloom in the first decade of the new century, aimed chiefly at regulating big business and reforming government, including a more progressive federal tax structure. On the state level, Governor Robert M. La Follette Sr. (1901-06) made Wisconsin a laboratory of Progressive programs and policies, and supported the reinstatement of federal income tax. So did the nation’s leading union, the American Federation of Labor, whose charismatic cigar-chomping president, Samuel Gompers, called for “a greater share of the tax burden upon those better able to bear it” at the organization’s 1906 convention. In national politics, President Theodore Roosevelt (1901-09) put forward a sweeping set of federal power– enhancing measures, but offered only tepid support for federal income taxation. Since 1907, yet another depression had been ravaging the nation’s economy, driving down employment, trade and tax revenues. At the end of TR’s second term, another battle loomed in the long income tax war.

Nelson Aldrich and the Amendment Gambit

As so often before, the income tax was wrapped up in a tariff fight—in this case, a battle over the Payne-Aldrich Tariff Act of 1909. Republicans Sereno E. Payne of New York (House majority leader) and Nelson W. Aldrich of Rhode Island (Senate majority leader and chairman of the Finance Committee) drafted the bill in response to a call to action on the issue by President William Howard Taft (1909-13) soon after he occupied the White House. Taft supported tax and tariff reform as a presidential candidate, leading most of his fellow Republicans to believe that as president he would push to lower tariff rates dramatically.

But once in office, Taft punted. He made a brief, vague speech, and charged Congress with drafting tariff reform legislation. Aldrich suddenly found himself working with both sides of the political aisle. About his own position there was little mystery, however. After serving in the Union Army, Aldrich had both earned and married into considerable wealth, and by this time had spent decades at the center of Rhode Island and national politics, especially economic matters. As a general principle, he opposed new or higher taxes. To his constituents he had pledged “no income tax, no inheritance tax, no stamp tax, no corporation tax.” But as a consummate politician, he could horse trade with the best of them.

Taft’s views on federal income taxation were somewhat complicated and at times contradictory. He favored the centralization of executive authority, including the power to tax, but saw federal income taxation as an emergency measure best reserved for times of war. He also doubted the federal bureaucracy’s capacity to collect income tax broadly, which would only penalize the honest. And like many Supreme Court watchers, he feared a repeat of Pollock, even if legislation was passed.

The president cared most about passing tariff reform and a new federal tax on corporations. Like many Progressives, he saw information—transparency, in modern parlance—as key to the oversight and regulation of corporations, especially dangerous trusts. The income tax mechanism would allow the government to gather revealing information about corporate finance and operations. The provision was controversial because corporations were (and still are) chartered at the state level. For the corporation tax and tariff reform, Taft was willing to sacrifice—or at least trade—the federal income tax.

And so the master of the Senate and the new president met to strategize about taxes and tariffs. According to Taft’s version of events, Aldrich came to see him about the worrisome coalition of Democrats and insurgent Republicans pushing for a federal income tax. The president convinced the conservative lawmaker that if he didn’t support the moderate tariff and tax proposals, a more radical version (in the form of an income tax amendment to the tariff bill) would likely pass. “It was either the corporation tax or the income tax or no bill at all,” the president recalled warning Aldrich. Taft would later boast to one of his brothers, “The situation was not one of my yielding to Aldrich, but of Aldrich coming to me.”

Whether motivated by Taft’s threat or his own political calculations, Aldrich came out in support of a constitutional amendment on the federal income tax. He apparently considered such an amendment doomed, and later conceded that he accepted Taft’s approach “as a means to defeat the income tax.” His strategy was hardly a secret; in his home state, the Providence Evening Bulletin asserted that Aldrich supported a federal amendment “only as a means of staving off the immediate enactment of an income tax law.” It was a stunning misstep.

Over the next four years, Aldrich, Massachusetts Republicans Henry Cabot Lodge and Winthrop M. Crane, and other “stand patters” watched with growing dismay as the proposed amendment gained momentum. Nine states ratified in 1910, 21 in 1911, four more in 1912, then eight in 1913—a comfortable margin beyond the two-thirds needed for passage. Support was very strong in the West, the region most dependent on federal largesse, where six states ratified unanimously and several others nearly so. It seemed ironic to some observers that no Western state had enacted its own income tax, but that was because plains and mountain folks saw Eastern fat cats as the problem; redress had to come nationally, they believed. As one Kansas legislator put it, “We are going to make you men of the East bear your burden of taxation.” (In the West, only Utah refused to ratify, thanks to Mormon moneyed interests.)

Except for Virginia and Florida, Southern states voted solidly to ratify. There were pockets of opposition among a rising business elite in the South—the so-called Bourbons. But the preponderance of Democrats, the interests of small farmers and the absence of a strong manufacturing base needing tariff protection combined to overcome the region’s deep-seated resistance to federal power.

Nor did the Northeastern states vote as a bloc—although, with 60 percent of the nation’s income and 189 of America’s 206 millionaires living there, the region was the seat of greatest resistance. New York ratified in 1911, but Pennsylvania, Connecticut and Rhode Island voted against the amendment. The Empire State (home to 119 millionaires) was, of course, the main act. Congressman George N. Southwick touted the prevailing elite view by deriding the federal tax proposal as “socialistic” and “a penalty upon industry and thrift.” Millions of working-class immigrants in the city and most upstate farmers felt differently.

Tellingly, several of Aldrich’s allies in the amendment gambit came from states that failed to ratify: from Virginia, U.S. Senator Thomas Martin and Richard E. Byrd, speaker of the state House of Delegates; from Pennsylvania, Senator Boies Penrose; from Connecticut, state Republican Party boss J. Henry Roraback; and from Utah, Senator Reed Smoot. Like Aldrich, these strong opponents of a federal income tax wagered that the amendment drive would never succeed.

The ratified amendment, quickly put into effect by the Underwood-Simmons Tariff Act of 1913, was more moderate than the short-lived measures of the Civil War and 1894— which offered some consolation to Aldrich and his comrades. It taxed individuals and corporations only 1 percent, with a high exemption threshold of $3,000 for single taxpayers. A graduated surtax of up to 6 percent was levied on incomes over $20,000. In the first several years after passage of the amendment, only the top 2 percent paid. As before, consumption taxes supplied the bulk of federal revenues.

National emergencies changed all that. During World War I, federal income taxes played a key role in funding expanded state capacity, a pattern repeated in the Great Depression. During most decades since, they have expanded and grown more progressive, and even when scaled back by conservative political leaders, are sustained at levels that Nelson W. Aldrich would have struggled to comprehend.

David B. Sicilia is associate professor of history and Henry Kaufman Fellow in Business History at the University of Maryland and co-author of The Greenspan Effect: Words That Move the World’s Markets.

Originally published in the December 2013 issue of American History. To subscribe, click here.